Turnover

The impact of high turnover

The trucking industry powers our country. Without it, shelves would be empty and we wouldn’t have access to nearly anything we need or use on a regular basis.

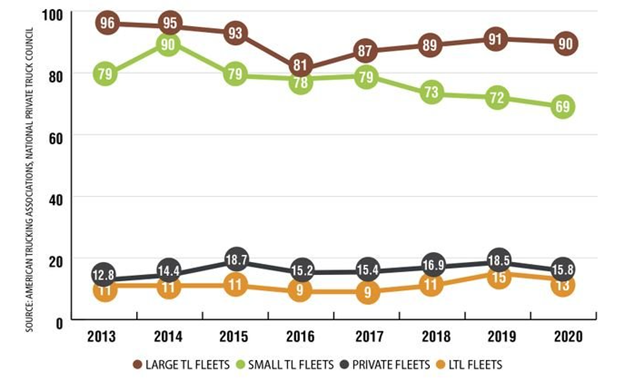

It is clear truck drivers are important. Aside from the driver shortage already plaguing the industry, another major concern is the high turnover rate. At around a 90% turnover rate for large fleets, it is one of the highest rates in the country.

Generally speaking, people often associate turnover with leaving the industry. When it comes to truck driving, however, that’s not the case. In a majority of cases, turnover in the trucking industry means switching companies. The kicker to all of that- in 2021, carriers lost about one new driver for every twenty they hired IN THE FIRST SEVEN DAYS.

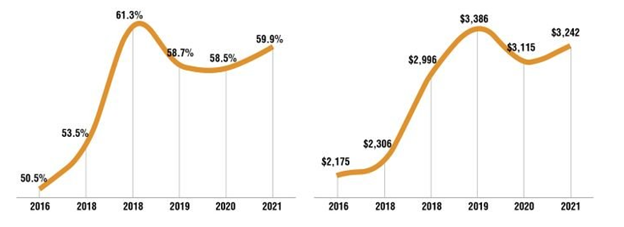

Turnover happens in every industry for various reasons. Truck drivers are in such demand that companies are incentivizing drivers to come work for them with huge sign-on bonuses and more competitive pay. In 2016, about fifty percent of companies were offering sign on bonuses that averaged around $2,000. It peaked in 2018 at 61% with a bonus of about $3400. Last year, wasn’t too far off from that peak- 60% of companies offered sign on bonuses that averaged almost $3300. Companies like Wal-Mart offered $8000 sign-on bonuses in 2021.

What does high turnover in the trucking industry mean for all of us?

It’s pretty simple- higher prices. Companies are losing a lot of money to turnover. The recruiting, hiring, training, and bonuses associated with hiring new truck drivers doesn’t come cheap. It costs thousands of dollars that essentially get thrown out the door when the driver quits for a new sign-on bonus. Companies don’t take on this cost without passing it through the supply chain, ultimately ending up to the consumer with higher priced goods. I think we are all feeling the higher prices at this point.

**All stats and graphics from Trucking Info.

Reefer Market

The Rollercoaster Market

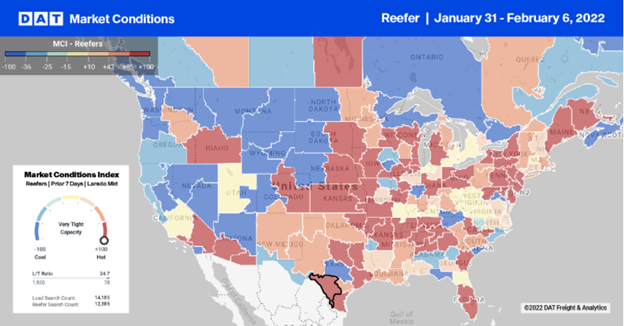

The market that tends to see the most fluctuation is definitely the reefer market. The ups and downs are so drastic that the swings often occur weekly.

That holds true in recent weeks. Just take a look at the graphic from DAT to the right. The number of loads available in the spot market compared trucks continues to flow like a rollercoaster. In theory, as we continue to get into peak produce season, these numbers should flatline on the higher end.

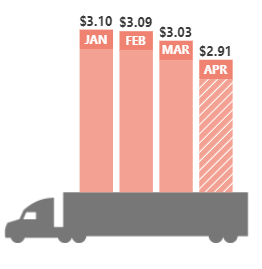

The closer we’ve gotten to produce season this year, the quicker reefer rates continue to drop. Reefer rates are always higher than van rates due to the extra cost and risk involved with temperature-controlled freight, but the gap isn’t as big as it has been in recent history. In fact, in some parts of the country, rates are only thirty cents per mile higher.

Rates are still slightly higher than they were a year ago, but not by much. The reefer rates in April are averaging over thirty cents less than they were only three months ago. Will this trend continue? Probably not in the short-term because load volume will pick up over the next couple of months and mess with the supply and demand ratio.

The good news is, for the first time in a long time, trends are starting to turn in our favor. Whether or not that will continue and be sustainable is yet to be determined.

Do you need temp-controlled freight moved? Are you tired of unreliable service? Do you value honesty and proactive communication? If you answered “YES” to any of those questions, you need to give us a call. We can help with all of those things…AND…save you money in the process.

Give us a call at 513-575-7645!

Tire Blowouts

Temps rise & so do number of blowouts

As temperatures continue to rise, so does the dreaded tire blowout.

It is a real problem, especially in the summer. There are ways to prevent it from happening, but nothing is 100% fool proof.

There’s a long list of reasons a driver could experience a tire blowout. We don’t have time to address them all, but let’s start with a top-5 list and then break down (no pun intended) a few of them to get a better understanding of what happens:

1. Heat/Weather

2. Driver Negligence

3. Defective Tires

4. Overweight

5. Potholes/Object on the road

Obviously heat and weather are out of anyone’s control, but it can be one of the leading causes of tire blowouts. It is exponentially worse between mid-May and early October due to the rising temperatures across the country. Driving for long periods of time in high temperatures puts a lot of strain on tires. Add in even hotter temperatures on the road itself, and it’s no surprise the damage it can cause.

Driver Negligence and defective tires could go hand in hand at times. Drivers are required to do pre and post trip inspections, primarily for safety. One of the parts they should inspect are the tires. They need to confirm they are inflated properly and make sure they are not overworn- both of which could lead to tread separation if not properly addressed. Drivers also need to look for any defects that are visible. Not all defects are visible, some are inside the tire. These types of defects are likely to cause tires to blow when they go over potholes, broken glass, or bumps in the road.

There are strict weight guidelines for multiple reasons, but one is definitely tire capability. Overloading cargo can put too much pressure on tires and cause them to explode. It is important for drivers to go scale if there is any question that the load could be overweight.

Obviously, no one wants to be in that situation. Tire blowouts can cause serious accidents and a lot of damage. It is vital that all precautions are taken and that everyone remain calm and in control in the event that it does happen. And a friendly reminder: if you see a truck (or anyone for that matter) on the side of the road, please pull over and/or slow down. It’s a stressful situation by itself, let’s all do our part to not make it any worse.

Let’s Talk Changes

Industry & Pricing Changes

Table Talk Tuesday is back!

Today, Team Jake talks about industry changes over the years and how prices/costs have increased over the years. Better yet, they talk about how we handle them and how our customers should navigate the ever-changing dynamics of shipping freight. Enjoy today’s video below.

Dry Van Market

Sometimes, trends can be deceiving.

Today we’re reviewing the dry van market and it may appear to be what you expected.

It doesn’t always make sense. We often use numbers to explain why things are the way they are, but sometimes you have to dig a little deeper to understand why the numbers just seem…off.

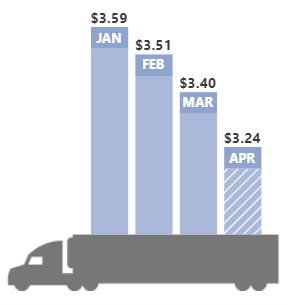

That’s what happened when we checked out the DAT trendline data for dry vans. At first glance, it looks great- rates are declining quickly. However, if you take a deeper dive into it, it’s not exactly what it seems. Let’s work through it in pieces.

The number of van loads posted on the DAT load board compared to trucks available increased the last week of March, but compared to February, it decreased almost 38%.

The rates are still higher than they were a year ago by 14%, but the trend week over week and month over month is on the decline- at a rate of about 1-2% depending on the time frame.

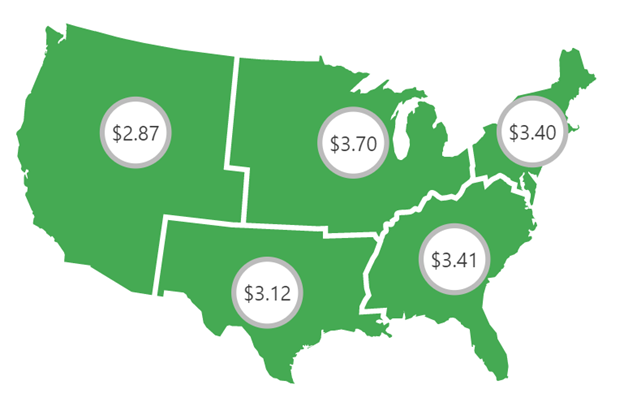

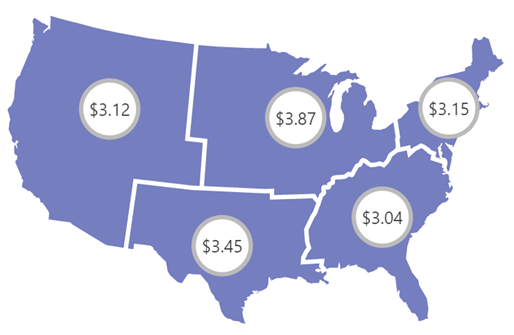

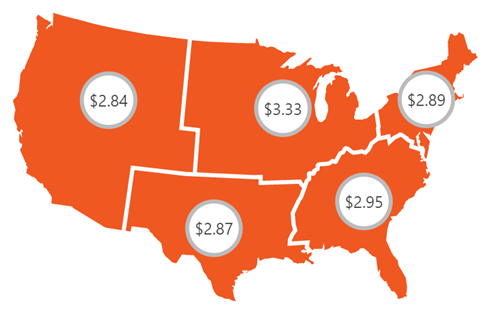

For the first time since December 2021, van spot rates have dropped below $3 per mile on average. While that trend is definitely favorable for the freight industry, there’s also more to consider than just the spot rate: fuel & location being major contributors.

The graphics from DAT below don’t include fuel. The spot rate may be dropping, but the total rate with fuel included isn’t making that kind of significant drop.

Fuel is, however, starting to drop slowly, so the industry may start to feel the impact in the near future- just not yet. It also depends what part of the country you are in. If you’re in a hot market, rates are remaining steady or even dropping a little. If you aren’t, you’re likely still feeling increases.

The good news is, for the first time in a long time, trends are starting to turn in our favor. Whether or not that will continue and be sustainable is yet to be determined.

Fallouts

The dreaded fallout

One advantage to working with PGT is that you don’t have to deal directly with truck problems. We do that for you. Let’s be honest, that’s a good thing for you.

Just like all aspects of logistics, carriers come with their own set of challenges. Our goal is to minimize those as much as possible, but sometimes things are just out of everyone’s control. Instead of passing that headache on to you, we handle it for you.

One of those challenges is “the fallout.”

Carriers often book loads and then have to drop off the load after the fact. As a broker and a shipper, that can be very painful, especially if the freight is time sensitive.

Why do carriers fall out?

We wish the answer was black and white.

There’s a long list of reasons a carrier may not be able to hold up their end of the agreement.

- Breakdown

- Delayed at previous receiver

- Weather

- Driver Emergency

- DOT Inspection

The reality is sometimes they just find a better load. “Better” could mean a few different things, too.

- Less deadhead miles

- Delivers closer to home

- Gets driver to a better outbound shipping location

- Lighter/Easier load

In today’s market, however, one of the most common reasons for fallouts is money driven. Due to the tight capacity across the country (see previous blogs on driver shortage), carriers have options to be pick and choose more than they ever have. Majority of the time, they will pick the loads that pay the most money per mile. Can you blame them? No, not really.

In an effort to minimize fallouts, PGT takes some extra steps.

- Vet our carriers with multiple different tools.

- Use our preferred carrier base first, every time.

- Communication is key- we always explain the expectations up front, in detail. We also make sure carriers understand what happens if those expectations aren’t met.

- Use our TMS to document all previous fallouts.

Avoiding carrier fallouts is impossible, but we promise to handle it so you don’t have to. We will keep open lines of honest communication with you and will recover the load with a new carrier immediately. The conversation isn’t always easy, but we believe it is necessary in order to build a valuable partnership.

Table Talk- Carrier Tips

PGT Tips for Carriers

Fun and exciting things just keep coming at PGT. In April, we are introducing a new feature: Table Talk Tuesdays!

This could mean many different things: tips for customers, PGT insider information, industry changes, etc.

Our first episode of Table Talk is geared toward our carriers.

Check out the video below for Carrier Tips with Kandra, Taylor & Jake.

Produce Season

Produce in Full Swing

Spring is here. That means we’ve kicked off produce season.

What is produce season? It seems obvious, but the reality is, there are so many variations of fruits and vegetables that it makes it a little more complex. Add in the different types of weather and temperatures across the globe, and produce is technically moving year-round.

But…here we are, in peak season, which generally runs February through July. This is when the largest volume of fruits and vegetables are harvested and shipped to manufacturers, grocery stores and various other vendors across the country.

The real question this time of year: how does peak produce season impact truck rates?

I think we all know what happens when demand for trucks rises, right? If not, let us clarify. Capacity shrinks. It’s not the best ratio, but the number of trucks and drivers doesn’t change just because there is more volume. In addition to that, refrigerated trucks are in even higher demand, so the rate for reefers increases drastically this time of year.

That’s all great information, but what does the data tell us?

According to DAT, spot market freight rates rise over 30% in the spring, peaking toward the end of March. Because of this, carriers will intentionally position their trucks in the produce states- mostly southern states & California. This impacts shippers in other markets because they experience capacity shortages in their areas because more trucks are looking for the higher produce rates. This generally drives rates up for other equipment- vans, rail, LTL, etc.

How big is the increase? Spot rates (not including FSC), have increased by almost $1.00/mile in the last three months, per DAT. Comparing that to two years ago, rates have increased over 120% this time of year, averaging almost $5.00 per mile.

Let PGT Help

To try and combat higher prices, reach out to us. We can help with spot market rates with our preferred carriers, but we can also work together to put some contracted rates in place so you don’t feel such a dramatic price increase during peak season. And a big thing- put your focus on being that one shipper everyone loves. Have flexible shipping and receiving hours, driver-friendly facilities, and treat drivers like they will be handling your valuable freight…because, well, they are! By doing this, you will become a shipper that carriers will gravitate to and will be more willing to run at lower rates.

Flatbed Market

Spring has sprung...flatbeds?

Spring is here. Many associate this time of year with produce loads. Not today. Today we’re reviewing the flatbed market.

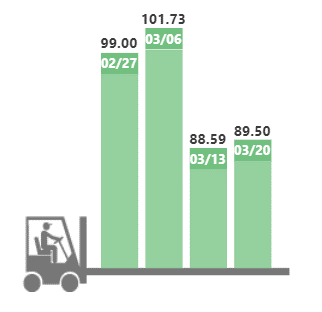

When the temperature starts to rise, so does the load volume for flatbeds. Over the last couple of weeks, the number of flatbed loads moving increased by more than 7%, according to DAT. The load post volume on DAT’s load board have also increased by about 18%. The number of carrier equipment being posted through the DAT system has also increased.

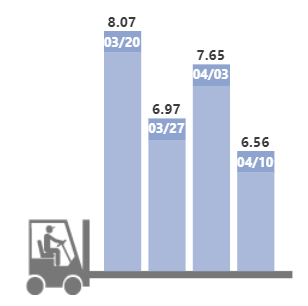

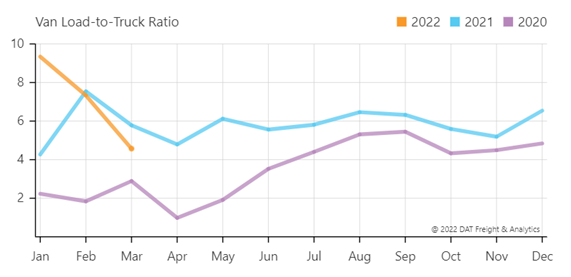

What does that mean? The short answer is that capacity is tightening. Yes, there are more loads and more equipment being posted, but the load to truck ratio isn’t increasing at the same rate. In fact, the recent DAT load-to-truck ratio trends are seeing a significant drop. (You can see the load-to-truck ratio according to DAT in the graphic to the right.)

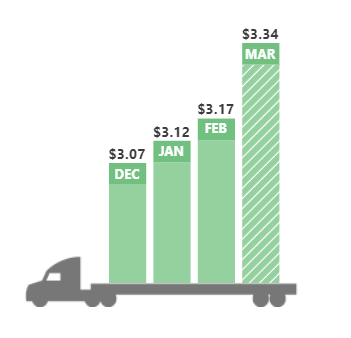

What is this doing to the flatbed rates?

As the month progresses, so does the spot rate. Last month, flatbed rates were increasing weekly by about one cent per mile. By the end of March, spot rates are expected to have increased by almost ten cents per mile throughout the month and almost 20 cents per mile more than February. How does that compare to this time last year? It’s almost 30 cents higher than March 2020. The last time there was this big of an increase in the flatbed market was 2018. The spot rates are almost 80 cents higher per mile in 2022 than they were in 2018. Wow.